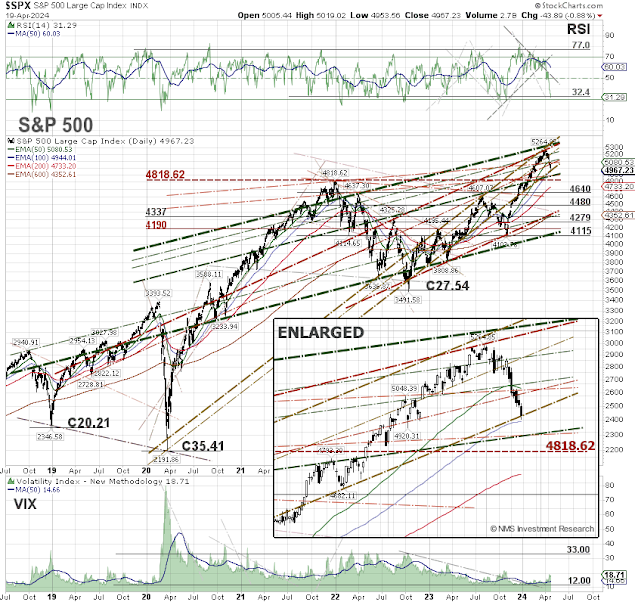

S&P 500: Keep an eye on Fed Meeting (Apr/May 30-1)

The S&P 500 bounced off the trendline support and broke above its 50-day EMA on Friday after Microsoft, Alphabet and Meta reported better-than-expected earnings during the week. Over 60,000 AI and machin e learning startups could keep data centers busy for the time being. Nvidia stock was up over 10% for the week after the company delivered the first DGX GH200 supercomputer to OpenAI. The next Fed Meeting is on April 30 and May 1. The market is expecting that the Fed will cut interest rate s at least twice this year, beginning in September. Maybe we will see a breakout after the Fed meeting. This note contained herein is our opinion and should not be construed as a recommendation to buy or sell. Click here to view the latest update !